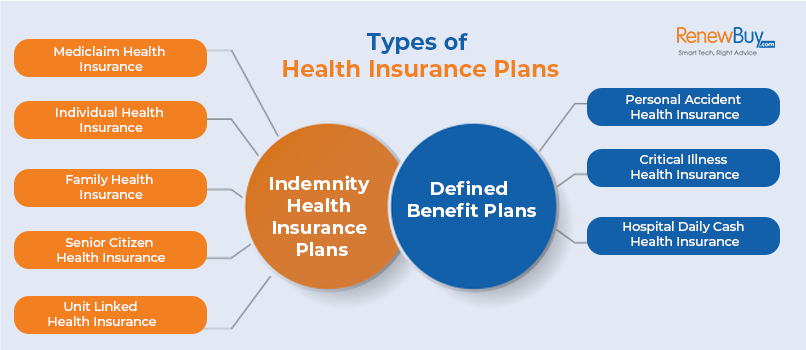

Types of Health Insurance Plans

Types of Health Insurance Plans

Health Insurance for Family

Family health insurance offers insurance coverage to entire family against a single premium. Under this health plan, a defined sum insured is divided among the members equally, which can be claimed by one or more family members during the policy term.View Plans

Health Insurance for Senior Citizens

Senior Citizen health insurance plans offer insurance coverage to the age group of 60 years and above. The health insurance plan covers hospitalization expenses like in-patient, pre and post-hospitalization expenses, OPD expenses, Daycare procedures with tax-saving benefits.View Plans

Health Insurance for Critical Illness

Critical illness health insurance plans offer a lump sum amount in case the insured is diagnosed with a critical illness such as kidney failure, paralysis, cancer, heart attack, etc. Usually brought as a standalone policy or as a rider, the sum insured is pre-definedView Plans

Health Insurance for Parents

Health insurance for aging parents refers to the senior citizen health plans that are designed for elderly people above the age of 60 years. It is essential for aging parents as they are more vulnerable to health risks like heart ailments, kidney ailments, and other critical illnesses.View Plans

Health Insurance for Coronavirus

Post COVID-19 outbreak, the IRDAI has also launched two Coronavirus specific health insurance plans i.e. Corona Kavach health plan and Corona Rakshak health insurance plan. Corona kavach is a family floater plan while Corona Rakshak is an individual coverage based plan.View Plans

Health Insurance for Diabetic

Health insurance for diabetes covers hospitalization expenses for diabetic patients, who otherwise find it hard to get insurance cover. The policy can cover both Type 1 and Type 2 diabetes and related medical complications. Tax benefits on the premium can also be availed.View Plans

Personal Accident Health Insurance

Personal accident insurance is a health policy that reimburses the medical costs incurred on hospitalization due to death or disability caused by an accident. The insurance company pays a certain amount as per the nature of the disability.View Plans

Courtsey To : Policybazaar

Average Rating