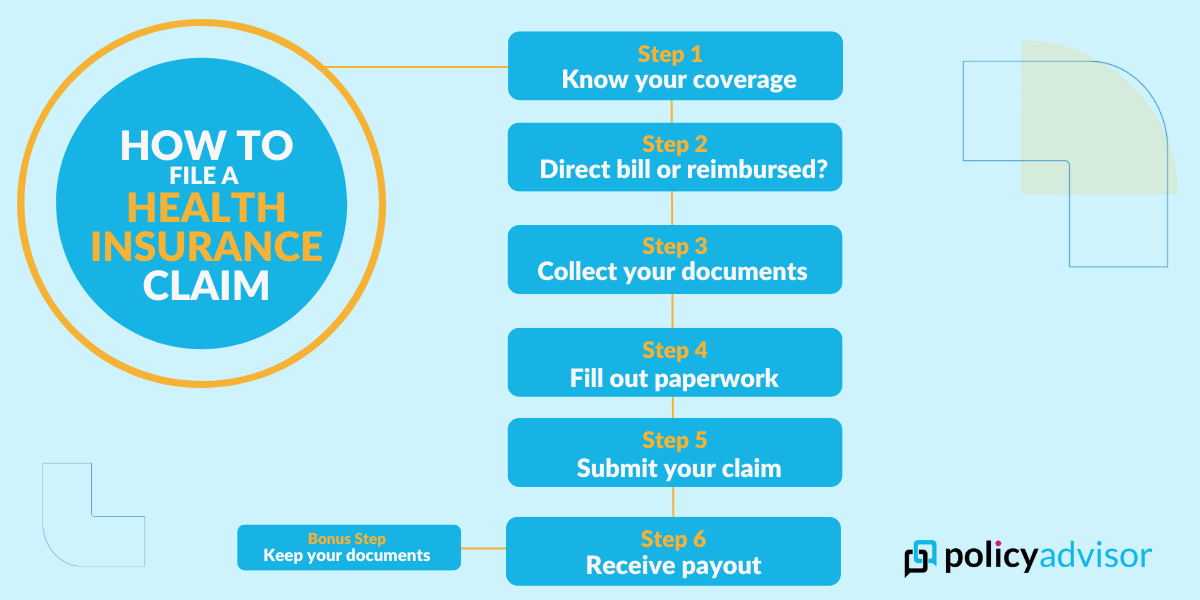

How to File a Health Insurance Claim?

Health insurance plans offer cashless treatment and expense reimbursement by the insurer. Traditionally, cashless claims were only available at network hospitals. However, with the “Cashless Everywhere” feature, you can file a cashless claim at non-network hospitals up to the sum insured limit of your health insurance policy. There are two types of claim processes:

1. Reimbursement Claims

For the treatments availed in non-network hospitals, the policyholder can file a claim for reimbursement of the treatment charges. Once the treatment is completed, the insured needs to settle the bill, collect all the documents, and submit them to file a claim with the insurer or the TPA for reimbursement.

2. Cashless Claims

If the treatment is availed in a network hospital of the insurer, then the policyholder will be eligible to avail cashless treatment services. Once the treatment is completed the insurance company settles the bill directly with the hospital.

For both cashless and reimbursement claims, the procedure for planned and emergency hospitalization may vary as given below:

In Case of Planned Hospitalization:

- You need to inform the insurer at least 48 hours before the treatment.

- Once you get the approval from the TPA/insurer, you can then file for reimbursement or cashless claims on submission of the claim form.

- Also, submit other related documents like medical bills, reports, discharge summary, etc.

- Once the approval is provided, the claim amount is paid to you by the insurer in case of reimbursement claims.

- In the case of cashless claims, the hospital bill is directly settled by the insurer.

In Case of Emergency Hospitalization:

- You need to inform the insurer within 24 hours of getting hospitalized.

- Showcase your health card at the hospital.

- Submit the pre-authorization form to get TPA approval for emergency hospitalization for cashless claims

- If approved, the insurer will settle the claim amount directly with the network hospital

- If you fail to get TPA approval, you will need to file for reimbursement later.

- Submit all the required documents like hospital bills, discharge bills, etc., after getting discharged from the hospital.

- After verification of documents, the claim amount will be paid to you.

Courtsey To : Policybazaar

Average Rating