FD Calculator 2025 – Calculate Fixed Deposit Returns Online

A fixed deposit calculator helps you calculate the maturity amount for your deposit based on the prevailing interest rate for a particular tenure.

The calculator is easy to use and will help you compare different tenures with different interest rates from different banks, thereby making it easier to decide which bank and tenure gives you the highest maturity amount for your fixed deposit.

Updated On – 14 Jan 2025

Deposit Amount Maturity Amount ₹ 10,158

₹ 10,000 Total Interest Earned ₹ 158

Tenure (In months)

3 Months Rate Of Interest (%)

6.3 %

Reinvestment / Cumulative Monthly Payout

Quarterly Payout Half Yearly Payout

Maturity Amount

₹ 10,158

Total Interest Earned

₹ 158Check Your Credit Score Now

How to Use BankBazaar’s Fixed Deposit Calculator

BankBazaar’s FD deposit calculator is designed to be easy to use and 100% accurate in calculating the maturity amount of your FD deposit. All you have to do is input the following data.

- Deposit amount

- Deposit interest rate

- Deposit tenure

After that is done, click on the ”Calculate” button and the maturity amount will be instantly displayed on the same page.

Also, Check – RD Calculator

How an FD Calculator Can Help You Calculate Fixed Deposit Returns?

Here are some points as to how the FD calculators can help you:

- Simplifies complex and time-consuming process that involves multiple variables

- Saves time and speeds up the calculation

- Enables you to make an informed decision by enabling you to maturity amount and interest rates offered by different banks

Advantages of Using FD Calculator

There are several advantages to using BankBazaar’s FD interest calculator such as:

- Accurate calculations of maturity amounts help you decide the best tenure to choose for your deposit

- Input interest rates from different banks and compare to choose the best bank for your deposit

- Ensure accurate calculations every time and avoid mistakes

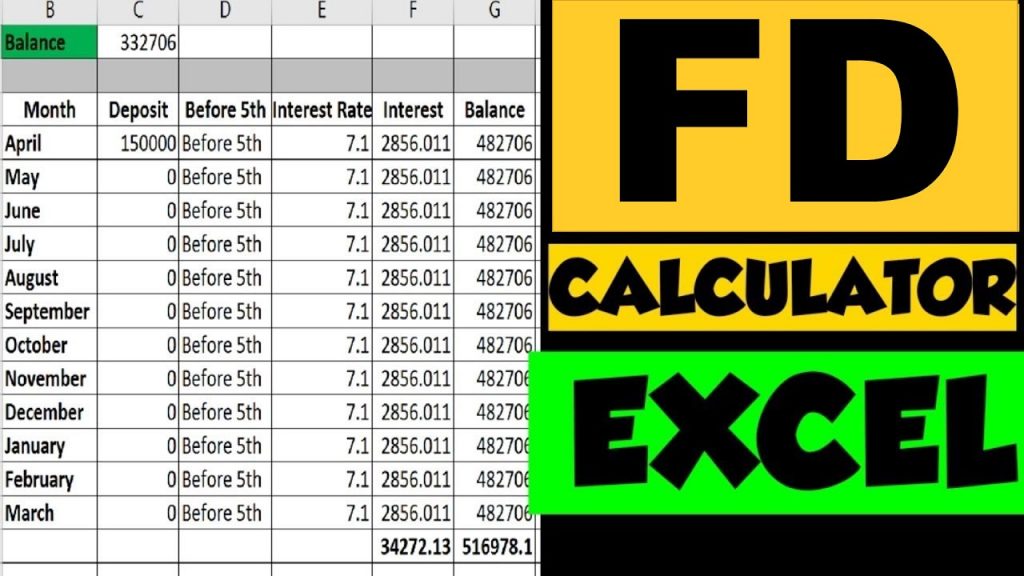

- Calculate maturity amounts much faster than using a digital calculator or spreadsheet

- Make better choices regarding renewals of fixed deposits by comparing the maturity amounts

What is Cumulative & Non-Cumulative Fixed Deposit?

Fixed Deposit that calculates the interest rate compounded and paid out after maturity is known as cumulative fixed deposit.

Fixed deposits that pay the interest periodically are known as non-cumulative fixed deposits that allow you to opt for monthly, quarterly, half-yearly, and yearly interest payout options.

Calculate Compound Interest with BankBazaar’s FD calculator

You can calculate the compound interest that will accumulate on your fixed deposit using BankBazaar’s compound interest calculator. Again, all you have to do is input the required data and click on the ”Calculate” button to get an accurate figure of how much your compound interest will be.Check Your Credit Score Now

How is Fixed Deposit Interest Calculated?

The interest rate on fixed deposit is usually calculated using two methods – simple interest and compound interest.

Simple Interest:

This is a pre-fixed rate of interest for a fixed period of time. It is calculated by multiplying the rate of interest per annum, the principal amount, and the tenure in years.

To take an example, if you deposit Rs.1 lakh at an interest rate of 10% p.a. for 5 years, then your interest amount at the time of maturity with a simple interest calculation will be the following:

SI: P x R x T/100

SI: 1,00,000 x 10 x 5/100 = 50,000

Maturity amount at the end of the 5-year deposit tenure: Rs.1.5 lakh.

Compound Interest

This is the interest earned on both the principal and interest amounts. It is calculated by multiplying the interest rate with the principal amount raised to the number of periods taken in years for which the interest is compounded.

A = P (1+r/n) ^ (n * t)

A = Maturity amount

P = Principal amount

r = rate of interest in decimals

n = number of compounding in a year

t = number of years

Check Your Credit Score Now

How to Use BankBazaar’s Fixed Deposit Calculator

For a deposit amount of Rs.10,000 that is kept for a tenure of 3 years at a quarterly compounding interest rate of 10%, the interest at the time of maturity would be:

A= 10,000 {1 + (0.1/4)} ^ (4 * 3)

A = 10,000 (1 + 0.025) ^ (12)

A = 10,000 (1.025) ^ (12) = Rs. 13,449 (approximately)

Compound Interest (CI) = Maturity Amount – Principal Amount

CI = 13,449 – 10,000 = Rs. 3,449

Maturity amount at the end of the 3-year deposit tenure: Rs.13,449

Other Banks FD Calculator

Be Money – Smart with our App

FAQs on FD Calculator Online

- What are the factors that affect FD interest rates? FD interest rates are affected by a variety of factors such as the tenure of the deposit, age of the applicant (senior citizens typically get higher interest rates), and current economic conditions.

- What is the fee for using the BankBazaar fixed deposit calculator? There is no fee for using the BankBazaar fixed deposit calculator. It is a free online tool that can be used by anyone free of charge and is available on a 24x 7 basis.

- What is the minimum tenure for fixed deposits? The minimum tenure for fixed deposits is 7 days.

- How is FD amount calculated? Fixed deposits are cumulative and non-cumulative. Cumulative FDs are calculated over the entire duration of the FD and are reimbursed to the depositor on maturity. While non-cumulative FDs are calculated monthly, half-yearly, and yearly basis.

- Is the FD interest calculator free to use? Yes, FD interest calculators are free to use. Several online platforms offer this facility to calculate the interest value of the FD for a specific tenure and amount.

- How to calculate the FD maturity amount? The fixed deposit maturity amount is calculated by the formula MV = (P x r x t)/100, in which MV is the maturity value; P is the principal amount deposited; r is the rate of interest; and t is the duration or the tenure of the FD.

- For which tenure is simple interest calculated? Tenures of less than 6 months have interest rates calculated using the simple interest method.

- Is it necessary to furnish any documents for using the online FD calculator? No, there is no need for any documents when using the FD calculator.

- Are there separate FD deposit calculators for different banks? You can use the BankBazaar FD interest calculator to calculate the maturity amount you will get from any bank based on their interest rates.

- How many times in a day can I use a fixed deposit calculator? You can use a fixed deposit calculator unlimited time in a day.

- Is the fixed deposit calculator available for use on mobile browsers? Yes, the fixed deposit calculator is available for use on mobile browsers as well.

- How many FD scheme interest rates can I calculate at a time using the FD calculator? You can only calculate the interest rate for one FD scheme at a time using the fixed deposit calculator.

- Where do I find the interest rate of fixed deposit schemes to input into the FD interest rate calculator? You can find the interest rates of all FD schemes offered by almost all leading banks in India on the BankBazaar website itself.

- How many years will FD double? The number of years in which FD will double is calculated by the formula which is 72 divided by the annual interest rate. If Rs.20,000 is deposited as FD in a bank for a rate of interest of 8%, then the FD will double in 9 years (72/8 = 9).

- Is the FD interest rate paid out monthly? Yes, some FD offers monthly interest pay out option, while most others provide the interest along with the principal amount after the maturity.

- Does FD offer compound interest? Whether the FD offers compound interest or not depends on the type of financial institution, FD amount, tenure, and FD type.

- How much is the FD interest rate for senior citizens? The exact FD interest rate for FD depends on the bank policy as the rates vary from bank to bank. But generally, the FD rates for senior citizens (above 60 years of age) are around 0.25% to 0.50% more than regular FD rates.

Courtsey To : Bankbazaar

Average Rating