Penalties for Not Having a Shop Act License

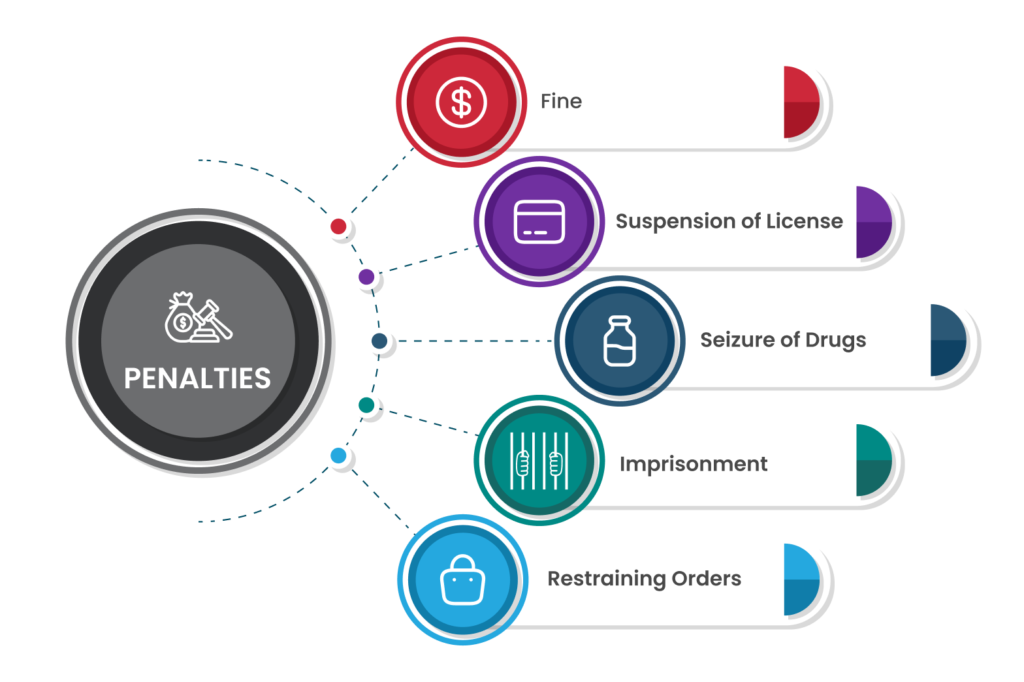

Not obtaining or renewing the Shop Act License can lead to various penalties:

- Fines: Businesses may have to pay large fines.

- Limits on Business Activities: There could be restrictions on how the business operates.

- Risk of Imprisonment: Responsible individuals might face imprisonment in certain situations, especially in cases of repeated or serious violations.

- Risk of Business Closure: The business might receive a notice to close down, either temporarily or permanently.

Procedure for Cancellation of Shop or Establishment Registration

In case a shop or establishment ceases operations, the following steps must be taken:

- Notification of Closure: The owner or occupier of the shop or establishment must inform the Chief Inspector in writing about the closure. This notification should be made within 15 days from the date of closure.

- Cancellation of Registration: Upon receiving the notification, the Chief Inspector will cancel the shop and establishment registration and the respective shop and establishment license.

- Removal from Register: The business will be officially removed from the register of shops and establishments.

Why Choose IndiaFilings for Shop and Establishment Registration?

IndiaFilings is a highly recommended choice for handling the Shop and Establishment Act registration process due to its extensive expertise and user-friendly services. We provide a streamlined, efficient approach to registration under shop & establishment act, guiding business owners through every step, from documentation to final submission, and reception of Shop Act License. Our expert team stays updated on the varying state-specific regulations and ensures compliance with all legal requirements, thereby minimising the chances of errors or delays.

Ready to ensure your business is fully compliant? Contact IndiaFilings today for professional guidance and a hassle-free registration experience.

Shop and Establishment Act License FAQ’s

What exactly is the Shop and Establishment Act registration?

It’s a mandatory legal process in India for registering businesses, including shops, commercial entities, and service providers, under respective state labour laws.

Who is required to undergo this registration?

It’s essential for businesses in trading, retail, customer interaction sectors, and other commercial activities as defined by respective state laws.

Why is this registration crucial for businesses?

It legitimizes businesses, ensures compliance with labour laws, and protects against legal repercussions.

Does the process of registration vary in different states?

Yes, each state in India has unique requirements and regulations under Shop and Establishment Act..

How can IndiaFilings assist in this registration process?

IndiaFilings provides expert assistance, managing the varied state-specific registration processes, documentations, and legal compliances.

What areas does the Shop and Establishment Act cover?

The Shop and Establishment Act regulates workplace conditions, including work hours, leave, wages, child labor, night shift norms, and record-keeping requirements.

Is the Act’s framework similar across India?

While there are state-wise variations, the fundamental principles of the Act are similar across India.

Can you list some of the key provisions of this Act?

Key provisions include setting standards for working hours, leave, payment structures, child labor prohibition, and ensuring safe working conditions.

What businesses fall under the Act’s eligibility criteria?

Eligible businesses include shops, residential hotels, restaurants, theatres, and other public entertainment venues, as well as a wide range of commercial establishments.

How is a ‘shop’ defined in this Act?

Under the Act, a shop is any premises where goods are sold or services are rendered, including offices and warehouses related to such activities.

What constitutes ‘commercial establishments’ as per the Act?

These include entities engaged in banking, trading, or insurance, administrative services, and any other business activities as defined by the Act.

Are there specific registration requirements for different types of businesses?

Yes, all businesses under the Act’s purview, including home-based and online businesses, must register and adhere to state-specific regulations.

Is it necessary for online businesses to register?

Absolutely, the registration requirement extends to e-commerce and online business ventures.

What is the deadline for completing this registration?

Businesses must register within 30 days of commencing operations to comply with the Act.

What is the role of the Shop and Establishment Certificate?

It’s a foundational document for businesses, necessary for obtaining other licenses, bank services, and serves as proof of legal establishment.

What advantages does registering under this Act offer?

Benefits include legal recognition, ease in banking processes, simplified inspections, access to government benefits, and reduced compliance burdens.

What are the essential documents for registration?

Documents include business address proof, proprietor’s ID, PAN card, employee information, and payment challan for registration.

What is the validity period for this registration?

The registration’s validity varies by state, ranging from a few years to lifetime validity, necessitating periodic renewals in some cases.

Why should I choose this registration?

IndiaFilings specializes in navigating complex state regulations, providing tailored guidance, and ensuring a hassle-free registration experience.

How does IndiaFilings ensure compliance with state-specific regulations?

IndiaFilings’ team stays updated on regional legal changes and variations, providing services that are tailored to meet the specific regulatory requirements of each state.

Does IndiaFilings assist with documentation and form-filling for the registration?

Yes. Our experts aids in preparing and compiling all necessary documents and accurately completing forms, ensuring a hassle-free registration process.

Are IndiaFilings’ services cost-effective for small and medium businesses?

Yes, IndiaFilings offers competitive pricing, making its services accessible and affordable for businesses of all sizes.

Average Rating