7. Merchant Banker role and responsibilities

SME Merchant bankers in India play a crucial role in both the pre-and post-issue IPO phases for small and medium-term enterprises.

Content:

- Types of Merchant Banker

- Role of Merchant Banker in SME IPO

- SME Merchant Banker Fee

- Parameters of evaluating a merchant banker

- SME IPO Merchant Banker performance

An SME IPO merchant banker (or lead manager), is a financial institution that helps the SME companies in raising funds through an IPO. These entities are registered with SEBI as merchant bankers.

SME IPO lead managers play an important role in the entire IPO process from pre planning stage to post IPO support. The success of an IPO depends heavily on the lead manager.

Lead manager vs Merchant banker

Merchant banker is the financial institution who applies for SEBI registration to act as the lead manager of an IPO. Though merchant banker is a broader term, these two terms are used interchangeably. Only a SEBI registered merchant banker can be appointed by companies to manage their issues.

Types of Merchant Banker

The Securities and Exchange Board of India (SEBI) classifies merchant bankers into four categories for registration purposes:

- Category I merchant bankers can manage the issues, provide advisory and consulting services, act as portfolio manager and underwriters.

- Category II merchant bankers can provide advisory and consulting services, act as portfolio managers and underwriters, but they cannot undertake issue management.

- Category III merchant bankers can provide advisory, consulting, and underwriting services only. They cannot perform the tasks required for portfolio management nor can manage the public issues.

- Category IV merchant bankers can provide only advisory and consultancy services. They cannot act as portfolio managers, underwriters nor do issue management.

The issuer company can appoint any number of merchant bankers to manage the issue. There is no restriction on the appointment of lead managers. However, when a company appoints more than one lead manager, the roles and responsibilities of each merchant banker/lead manager should be segregated and notified to SEBI about the same before one month of the issue opening date. The roles and responsibilities of each lead manager should also be listed in the offer document.

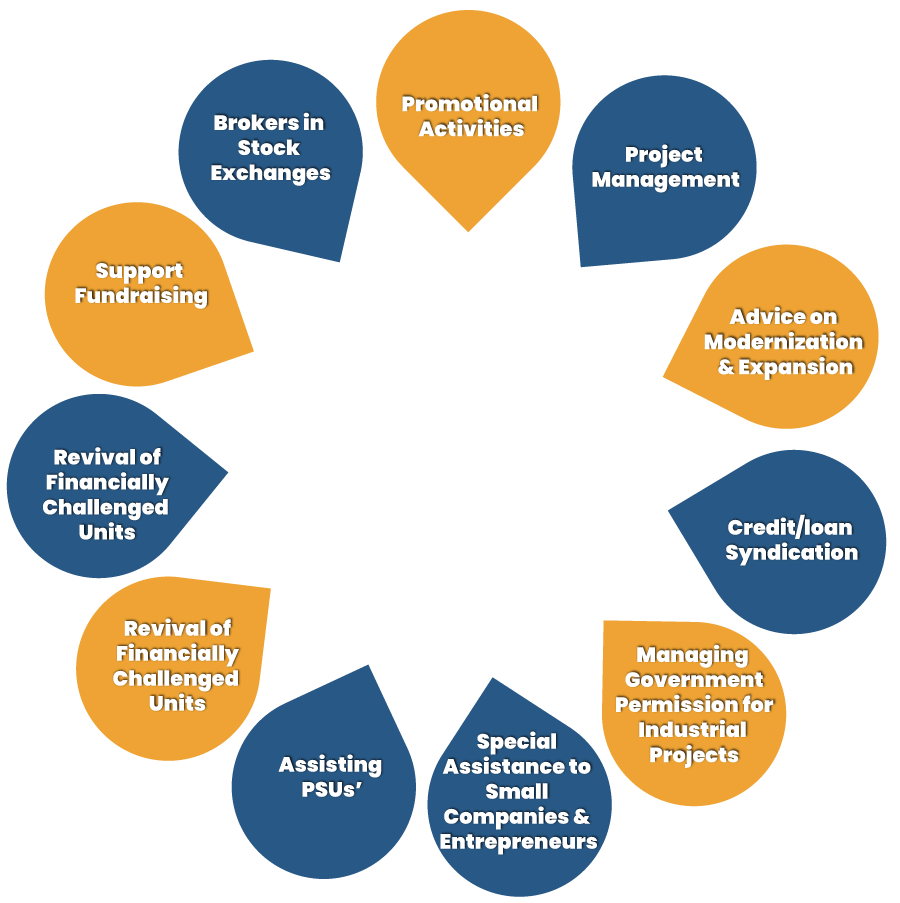

Role of Merchant Banker in SME IPO

An SME merchant banker plays a crucial role in the SME IPO process. Below are the tasks and responsibilities a merchant banker is required to execute throughout the IPO issuance process.

- Advisory services: Merchant bankers can assist, advise and guide the companies in their investment decisions, fundraising strategies, restructuring of the company and any other financial decisions.

- Educating the SME company: An SME lead manager is required to educate the applicant about the rules and regulations of the capital market, the IPO process, and the requirements after the IPO.

- Structuring the IPO : The lead manager assists the SME in structuring the IPO and helps determine the offering’s size, price and timing based on market conditions and the company’s financial position.

- Due diligence & DRHP Preparation: The merchant banker prepares the applicant’s prospectus and other listing documents. It shall conduct due diligence and issue required certificates and documents as per ICDR (Issue of Capital and Disclosure Requirements) regulations.

- Display of offer document on a website: Once the RHP is finalized and filed with the RoC (Registrar of Companies) and SEBI, the merchant banker is required to publish the offer document on its website.

- IPO valuation and pricing : This is one of the crucial tasks that requires the expertise of merchant bankers. The SME merchant bankers based on their experience use professional ways to value the company and accordingly decide the price for an IPO. Fair pricing and valuation are very important as it is one of the important factors that drive the investment decision of the investors.

- Marketing and Promotion : The lead manager markets the IPO to potential investors, including institutional investors, retail investors, and high-net-worth individuals. It conducts roadshows and presentations to generate interest in the offering.

- Market-Making arrangement: The Merchant Banker shall ensure mandatory market making through the stock brokers of SME exchange for a minimum period of three years from the date of listing of the SME IPO.

- Underwriting arrangement: The merchant banker must ensure that the issue is 100% subscribed and is required to keep 15% of the subscription amounts on his books.

- Share allocation : The merchant banker finalises the basis of allocation in consultation with the SME exchange.

- Arrangement with the nominated investor: Under the provisions of Chapter XB of the ICDR, merchant bankers may enter into agreements with designated investors (PE funds and QIBs as defined therein) to facilitate market making and underwriting. The merchant bankers must disclose their arrangements with nominated investors to the stock exchange in the final offer document.

- IPO Stabilisation : After the IPO listing, the lead manager can take stabilisation measures to support the share price and ensure a smooth start to trading. This may include buying shares on the secondary market to prevent excessive volatility.

- Post-IPO Support : The role of lead manager continues even after IPO listing. The lead manager assists the company in complying with post IPO reporting and disclosure requirements.

Overall, the lead manager plays a pivotal role in guiding the SME through the complex process of going public, from initial planning to post-IPO support, helping to ensure a successful offering and a smooth transition to being a publicly traded company.

SME Merchant Banker Fee

The merchant banker fees for SME IPO may range from 1% to 5% of the issue size. The fees charged by the merchant banker depends on various factors as listed below.

- IPO issue size – Generally a merchant banker charges a higher % of fees for lower IPO size and a smaller % for big size IPOs. This is because in case of small size IPOs, they do not get much in absolute terms when charged the same % of fees as in case of large IPOs. Eg: If a merchant banker charges 1% of issue size. In case of Rs. 20 crores issue, a merchant banker can earn Rs. 20 lakhs and in case of Rs. 10 crores, it will earn Rs. 10 lakhs. Thus, in absolute terms, the amount gets halved when the amount of work may remain the same. Thus, for a small IPO size, the fees may be slightly higher.

- Merchant banker experience and reputation – A reputed and experienced merchant banker may have higher fees than a new and less reputed merchant banker.

- Services offered by the merchant banker – The more the services offered by a merchant banker, higher the fees and vice versa.

- Overall market conditions – If the market conditions are unfavourable, the IPO success is daisy. This is a risk for a SME merchant banker who is required to underwrite 15% of the issue size. Thus, in such cases the fees may be slightly higher to cover the risk.

The fees charged by a merchant banker includes the below:

- Issue management fees that may include – Offer document preparation, IPO structuring, due diligence, and regulatory filings.

- Underwriting fees.

- Marketing fees.

- Post- IPO support fees.

A merchant banker generally charges a certain percentage of issue size as their fees. But in certain cases, some of the fee components may be fixed. The issuer company must clarify the basis of charging of fees and try to negotiate wherever possible which can help them cut down on the fees.

Parameters of evaluating a merchant banker

Choosing the right merchant banker for an SME IPO is a critical decision that can significantly impact the success of an IPO issue. Thus, an issuer company must analyse the below factors before appointing a lead manager.

- Market Reputation : A well-regarded lead manager can enhance the credibility of the IPO.

- IPO handling experience : An experienced merchant banker in SME space may have better capabilities in handling the IPO process well.

- Industry focus : An SME merchant banker with experience in a specific industry may be in a better position to understand the complexities, and dynamics involved in that particular sector.

- In-depth understanding of the market : An SME merchant banker who understands the capital markets well can help sail through the IPO process effectively as such merchant bankers can help understand the market and investor sentiments and market situation.

- Marketing skills: An SME merchant who can effectively execute marketing campaigns, roadshows, and investor presentations is in a better position to place the IPO well in the market.

- Track Record : A merchant banker with a proven track record may have higher chances of IPO success.

- Market making : Check whether the merchant banker can make arrangements for market-making.

- Resources : Ensure the lead manager has the necessary resources, including research, marketing, and financial expertise.

- Pre-IPO Advisory: Evaluate the advisory services provided, including help with valuation, pricing, and structuring the offering.

- Fee Structure – Review the fee structure and ensure it is competitive and transparent. Understand all costs involved, including underwriting fees and any additional charges.

- Regulatory Expertise : Ensure the lead manager is well-versed in regulatory requirements and compliance, particularly with SEBI regulations and stock exchange rules.

- Post-IPO Support: Consider the lead manager’s approach to post-IPO ongoing support, including managing post IPO reporting and disclosure requirements.

SME IPO Merchant Banker performance

The lead manager is critical to the success of an IPO. They set price for IPO, decide on IPO launch dates, IPO size and strategically place the IPO in the market to facilitate the sale of shares to public and institutional buyers. The issuer companies often check the profile of the lead manager before appointing for an IPO.

A lead manager is often measured on the below key criteria to assess their performance:

- Number of IPOs handled.

- Subscription levels of IPO.

- Listing performance of the IPOs.

- Post listing performance.

Refer to SME IPO merchant banker performance and Merchant bankers for SME listing to check the list of famous SME merchant bankers and their track records.

SME IPO Enquiry

SME Company Owners

We could help you get listed on the stock market. Contact us Today

Check our SME IPO Guide

Frequently Asked Questions

1. Who is SME lead manager?

SME lead manager, also known as the book running lead manager (BRLM), is a SEBI registered merchant banker that specialises in managing SME IPOs.

SME merchant banker is a key intermediary in the entire IPO process who is involved from the pre IPO to post IPO phase. The SME merchant banker is responsible for various important tasks like IPO planning, appointment of various other intermediaries, IPO valuation, strategic placement of IPO in market, listing formalities, post-listing disclosure and reporting requirements.

2. How many SME IPO lead managers can a company appoint?

There is no restriction on the number of IPO lead managers that a company can appoint for an IPO.

Generally, one to two lead managers are sufficient for handling the SME issues. For mainboard IPOs, the lead managers count can be more depending on the IPO issue size.

Here is the SME IPO merchant bankers list for easy reference.

Courtsey To : Chittorgarh

Average Rating