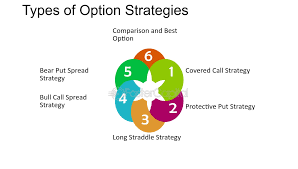

6. Option Strategies

Read Time:2 Minute, 45 Second

- 1. Orientation 1.1 – Setting the context Before we start this module on Option Strategy, I would like to share with you a Behavioral Finance article I read couple of years ago. The article was titled “Why winnin ..

- 2. Bull Call Spread 2.1 – Background The spread strategies are some of the simplest option strategies that a trader can implement. Spreads are multi leg strategies involving 2 or more options. When I say multi leg stra ..

- 3. Bull Put Spread 3.1 – Why Bull Put Spread? Similar to the Bull Call Spread, the Bull Put Spread is a two leg option strategy invoked when the view on the market is ‘moderately bullish’. The Bull Put Spread is s ..

- 4. Call Ratio Back Spread 4.1 – Background The Call Ratio Back Spread is an interesting options strategy. I call this interesting keeping in mind the simplicity of implementation and the kind of pay off it offers the trader. ..

- 5. Bear Call Ladder 5.1 – Background The ‘Bear’ in the “Bear Call Ladder” should not deceive you to believe that this is a bearish strategy. The Bear Call Ladder is an improvisation over the Call ratio back spr ..

- 6. Synthetic Long & Arbitrage 6.1 – Background Imagine a situation where you would be required to simultaneously establish a long and short position on Nifty Futures, expiring in the same series. How would you do this and more i ..

- 7. Bear Put Spread 7.1 – Spreads versus naked positions Over the last five chapters we’ve discussed various multi leg bullish strategies. These strategies ranged to suit an assortment of market outlook – from

- 8. Bear Call Spread 8.1 – Choosing Calls over Puts Similar to the Bear Put Spread, the Bear Call Spread is a two leg option strategy invoked when the view on the market is ‘moderately bearish’. The Bear Call Spread ..

- 9. Put Ratio Back spread 9.1 – Background We discussed the “Call Ratio Back spread” strategy extensively in chapter 4 of this module. The Put ratio back spread is similar except that the trader invokes this when he is b ..

- 10. The Long Straddle 10.1 – The directional dilemma How many times have you been in a situation wherein you take a trade after much conviction, either long or short and right after you initiate the trade the market move ..

- 11. The Short Straddle 11.1 – Context In the previous chapter we understood that for the long straddle to be profitable, we need a set of things to work in our favor, reposting the same for your quick reference – The vo ..

- 12. The Long & Short Strangle 12.1 – Background If you have understood the straddle, then understanding the ‘Strangle’ is quite straightforward. For all practical purposes, the thought process behind the straddle and strangl ..

- 13. Max Pain & PCR Ratio 13.1 – My experience with Option Pain theory In the never ending list of controversial market theories, the theory of ‘Option Pain’ certainly finds a spot. Option Pain, or sometimes referred to ..

- 14. Iron Condor 14.1 – New margin framework These are fascinating times we are living in, especially if you are an options trader in India Starting 1st June 2020, NSE’s new margin framework is live, which es ..

Courtsey To: Zerodha

Average Rating