Mutual Fund Returns

A mutual fund is an investment pool that is professionally managed by a fund manager. It pools funds from several investors with similar investment goals and uses those funds to purchase bonds, equities, etc.

Mutual funds are one of the best investment plans that offer higher returns and offers diversification. Even though investing in mutual funds carries some market risk, the returns can be roughly predicted. To calculate the expected returns, you can use a mutual fund return calculator.Check Your Credit Score for FREE

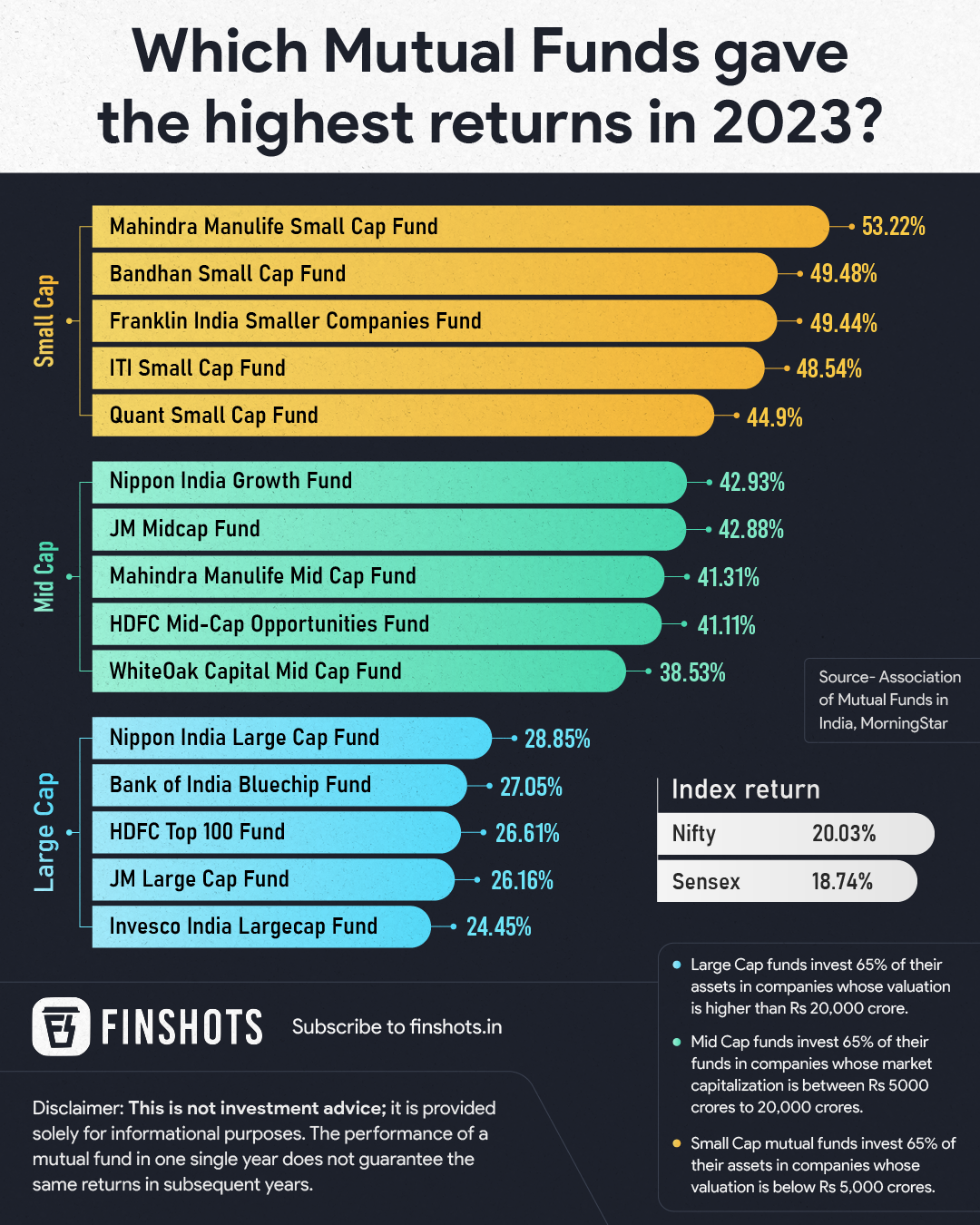

Estimated Returns from Various Mutual Funds in India 2024

List of Returns from Moderate Risk Equity Funds

| Scheme Name | 1 Year | 3 Years | 5 Years |

| Kotak Equity Savings Fund | 21.61% | 14.74% | 13.63% |

| Sundaram Equity Savings Fund | 21.43% | 14.27% | 13.41% |

| Axis Equity Saver Fund | 20.31% | 12.24% | 12.10% |

| HDFC Equity Savings Fund | 20.06% | 13.43% | 13.49% |

| Edelweiss Equity Savings Fund | 17.51% | 12.02% | 11.93% |

| PGIM India Equity Savings Fund | 10.09% | 7.87% | 8.89% |

Check Your Credit Score for FREE

List Returns from High Risk Equity Funds

| Scheme Name | 1 Year | 3 Years | 5 Years |

| HSBC Midcap Fund | 59.40% | 29.79% | 27.13% |

| Edelweiss Mid Cap Fund | 54.03% | 30.30% | 31.60% |

| Nippon India Growth Fund | 51.94% | 31.74% | 31.74% |

| Tata Midcap Growth Fund | 50.65% | 29.22% | 28.85% |

| Invesco India Mid Cap Fund | 50.45% | 28.45% | 28.52% |

| Nippon India Small Cap Fund | 47.64% | 34.40% | 38.22% |

| Mirae Asset Midcap Fund | 45.05% | 26.41% | NA |

| Axis Midcap Fund | 40.58% | 25.00% | 23.89% |

| HDFC Small Cap Fund | 40.55% | 31.44% | 33.51% |

| Kotak Emerging Equity Fund | 38.39% | 24.58% | 27.80% |

Check Your Credit Score for FREE

List of Returns from Moderate-Risk Tax-Saving Funds

| Scheme Name | 1 Year | 3 Years | 5 Years |

| Axis LT Equity Fund (G) | 5.24% | 16.74% | 10.59% |

| Invesco India Tax Plan (G) | 16.64% | 22.11% | 12.91% |

| Franklin India Taxshield (G) | 20.59% | 29.55% | 14.00% |

| DSPBR Tax Saver Fund – Reg (G) | 18.48% | 27.85% | 16.44% |

Returns from Hybrid Funds

| Scheme Name | 1 Year | 3 Years | 5 Years |

| Parag Parikh Conservative Hybrid Fund | 18.84% | NA | NA |

| Kotak Debt Hybrid Fund | 18.01% | 12.92% | 13.10% |

| HDFC Hybrid Debt Fund | 17.24% | 12.64% | 12.32% |

| Bank of India Conservative Hybrid Fund | 15.82% | 14.33% | 13.74% |

| ICICI Prudential Regular Savings Fund | 15.74% | 11.23% | 10.95% |

Check Your Credit Score for FREE

Types of Mutual Fund Returns

Absolute Returns

- Absolute Returns or Point-to-Point returns indicates the increase or decrease in investment, in terms of percentage.

- The absolute returns method of calculating returns is used for mutual funds with a tenure less than 1 year.

- If the period is more than one year, the investor has to calculate annualized returns.

- Example of Absolute Return calculation: Suppose the current market value of the investment is Rs. 4, 00,000 and the amount originally invested was Rs. 2, 50,000. In this case, the absolute return would be – [(4, 00,000-2, 50,000)/2, 50,000] = 60%.

Annualised Return

- Annualised returns measure the amount of growth in the value of your investment on an annual basis.

- For instance, let’s say that you made an investment of Rs.1 lakh in a MF scheme. In a span of three years, your investment has grown to Rs.1.4 lakh. In this case, your absolute return is 40%, but your annualised return is 11.9% because of the compounding effect.

Total Return

- It refers to the actual returns you have accrued from the investment.

- It includes dividends as well as capital gains.

- For instance, let’s say that you made an investment of Rs.1 lakh in a MF scheme, and the NAV was Rs.20. Since you made purchases worth Rs.1 lakh and the NAV is Rs.20, it means that you purchased 5,000 units. After a year, the NAV of the MF scheme increases to Rs.22, and the value of your units will be Rs.1.1 lakh (5,000 units x Rs.22 per unit), which means your capital gains shall be Rs.10,000. Now, in case the scheme declared dividends of Rs.2 per unit over the course of the year, the overall dividend paid to the investor shall be Rs.10,000 (5,000 units x Rs.2 per unit). Therefore, your overall accrued return shall be Rs.10,000 + Rs.10,000 (dividend + capital gains) = Rs.20,000, which makes your overall return = 20%.

Trailing Return

- It is the annualised return over a particular trailing period which ends today.

- For instance, if the NAV of a MF scheme today is Rs.100, and it was, let’s say, Rs.60 three years ago. The formula to calculate trailing return in a Microsoft Excel sheet is (Today’s NAV / NAV at the beginning of the trailing period) ^ (1/Trailing Period) – 1. Therefore, your three-year trailing return will be 18.6%. In case the scheme’s NAV five years ago was Rs.50, the five-year trailing return shall be 14.9%.

Point to Point Return

It is the annualised return recorded between two points of time. All you need to calculate point to point returns is the start date and the closing date of a mutual fund scheme.

Annual Return

As the term suggests, annual return essentially refers to the return earned from a scheme between the 1st of January and the 31st of December of a particular year. For instance, in case a scheme’s NAV on the 1st of January is Rs.100 and on the 31st of December is Rs.110, your annual return shall be 10%.

Rolling Returns

- They refer to a scheme’s annualised returns over a particular period of time.

- Rolling returns periods can be daily, weekly or monthly and shall be used until the last day of the duration in comparison with the benchmark of the scheme (for instance, Nifty, CNX – Midcap, CNX – 500, BSE – 200, BSE – Midcap, etc.) or fund category (for instance, midcap funds, large cap funds, balanced funds, diversified equity funds, etc.)

Compound Annual Growth Rate

- It is used to calculate the returns from mutual funds investment which has a holding period that exceeds a year.

- This would reduce the short-term fluctuations and volatility of the Net Asset Value of the funds. Under this method of calculating returns from mutual funds, it is assumed that the investment is growing at a steady pace

In order to calculate the Compound Annual Growth Rate (CAGR) manually, the equation is as follows:

CAGR = [(Current Net Asset Value / Beginning Net Asset Value) ^ (1/number of years)]-1

Check Your Credit Score for FREE

Related Articles on Mutual Fund

Check Your Credit Score for FREE

How to Calculate your Mutual Fund Returns Online?

You can use the mutual fund returns calculator online to understand how much returns will be yielded from the capital invested.

- All you have to do is enter basic details such as name of the mutual fund, scheme/ plan, the “from” and “to” date for returns and then click on “Calculate”.

- The results page would project the annualized returns and absolute returns availed during a period from 1 week to a maximum period of 5 years.

- Most mutual fund returns calculator also projects the performance rank of the scheme, within fund classes.

GST rate of 18% applicable for all financial services effective July 1, 2017.Check Your Credit Score for FREE

Be Money-Smart with our App

FAQs on Mutual Fund Returns

- What are returns on mutual funds? Returns on mutual funds are the profits or losses that investors make from their mutual fund investments over a certain time frame. These returns, which are frequently reported as percentages, serve as an important gauge of the performance of the fund.

- What is the average return on a mutual fund? Mutual fund returns are neither fixed nor guaranteed, and previous performance is no guarantee of future success.

- Can mutual funds have negative returns? Yes, there is always a possibility of receiving a loss when investing in mutual funds. However, you can prevent this with some financial strategy and professional assistance.

- Is a 10% return on a mutual fund good? Yes, a 10% return on a mutual fund is considered a good return.

- What is the average ten-year return on mutual funds in India? The average ten-year return on mutual funds in India is 20%. Mutual fund performance is directly correlated with market dynamics. Average returns may be higher during a 10-year period if there is a bull market, whereas average returns may be lower during a bear market or an economic slump.

- Does mutual fund returns are taxable? Yes, mutual fund returns are taxable.

- How much mutual fund is tax free? Up to a certain threshold, long-term capital gains (LTCG) from equity-oriented mutual funds—funds with more than 65% of their portfolio invested in stocks—were often tax-free. Under Section 80C of the Income Tax Act, equity mutual funds with a three-year lock-in period known as equity-linked savings schemes (ELSS) provide tax benefits.

- Courtsey To : Bankbazaar

Average Rating